GameStop Stopped Gaming: Wealth Erosion And Aftermath

At the peak of the event that was GameStop, an acquaintance reached to me to enquire if it was alright for her to buy GameStop stock. I cautioned immediately and advised against it. What became of GME stock afterwards was that of premium tears for the uninitiated.

I have a saying for which I have been labelled with on Twitter. “Know your game, play your game” goes the saying. Unfortunately, a lot of people take the stock market as one of a play. It is a brutal environment where your wealth can be wiped off overnight if you are not careful. So far, it gives me great joy that some people that I know have made wealth than burn wealth.

Knowing your game and playing your game is my way of telling everyone to have a reason for being in the stock market, have an investment strategy and don’t sway from your reason or strategy except you are doing so after much thought and intentionally. The fellow that reached to me is an example of someone not adhering to their game. And it would have cost her, glad she consulted before acting.

As GameStop rose rapidly, so did it fall rapidly. But those who made the most gain were not the retailers who thought they were gaming the system but the folks whom they think they outsmarted.

Ryan Cohen made $1.3B from the event.

This hedge fund made $700M

And the mastermind behind it all Keith Gill was a CFA charter who understands very well the world of investing. He is not some amateur at all.

Do you know what happened to the amateurs? The ones who didn’t know their game or who knows it but didn’t stick to it?

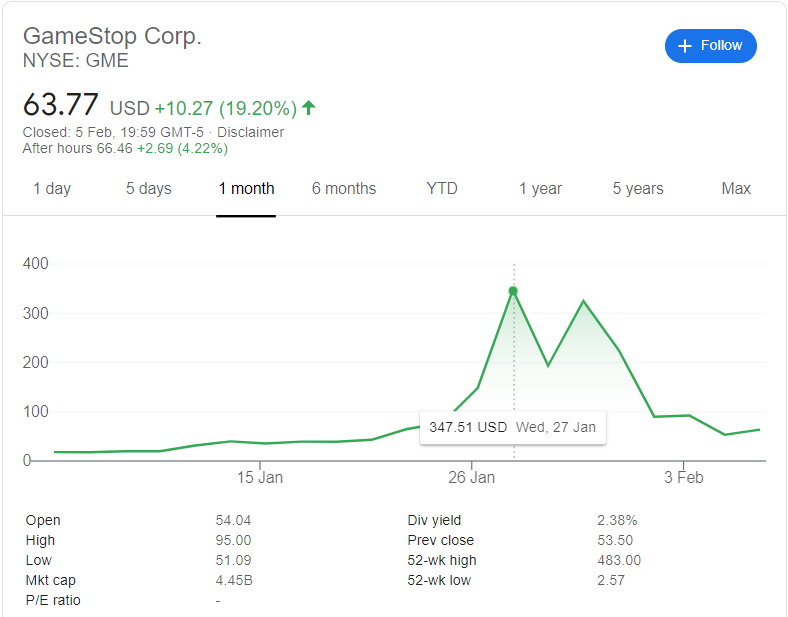

See this:

Then this too:

Then see this person lost $1m already and still hoping.

It is easy to think you can make easy money on the market, and make the maximum return possible but your goal, what you should be optimizing for, shouldn’t be about things like this. It shouldn’t be about being right 1% of the time like with GameStop but about being right 90% of the time and growing wealth slowly for that is the only sustainable way.