If You Miss The Best Days In The Stock Market Here’s What Happens

If You Miss The Best Days In The Stock Market Here’s What Happens

In the past week and days, the market has been consistently trading red. A lot of stocks fell as much as 15% from their all-time high, some even more. The natural tendency for anyone at such a time as this is to assume it is wise to take action by cutting their losses and wait for the market to get back in the green zone before they get back to investing. But that action could cost anyone a fortune.

As I’ve always noted, much of investment gains come from doing nothing. Yes, most gains come from inaction rather than action. And I think that’s why investing is extra hard. Humans (you and I) can’t possibly imagine that our inaction will make us wealthier than our actions.

Pulling out of the market during a downturn and waiting for recovery before you get back in the market sounds like a smart strategy. However, such a strategy also means potentially missing some very big upside days in the market, which could make an enormous difference in your portfolio’s performance over time.

Time the market over timing the market

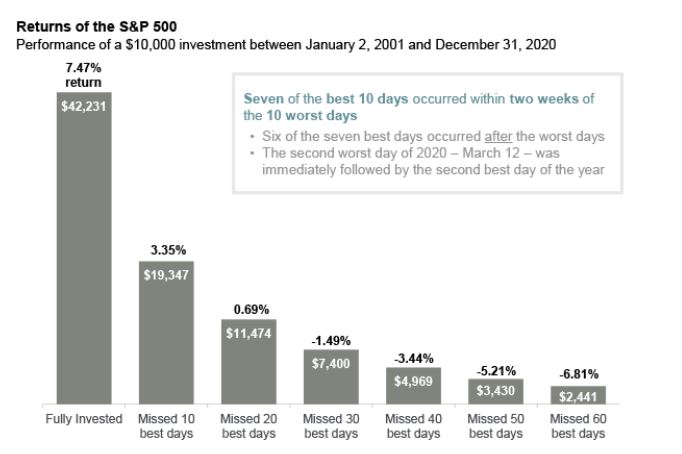

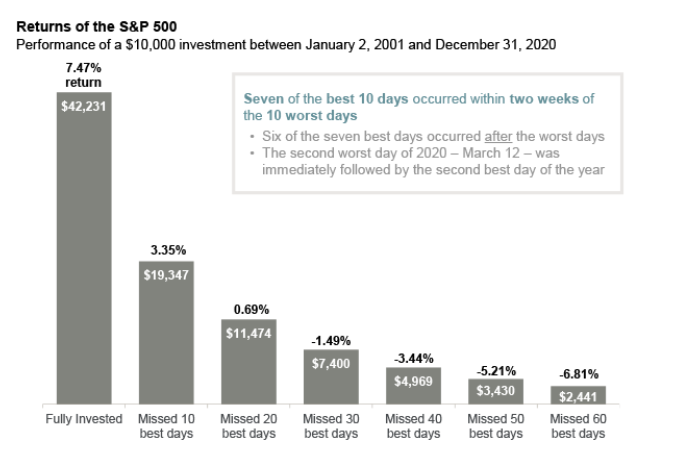

JP Morgan Asset Management did a 20 years study of the stock market, to learn about what difference a single day or series of days could have on investment returns.

They picked the S&P for the study. Analyzing 20 years of data between January 2001 and December 2020, data shows that if you miss the best 10 days in the stock market, your potential return will be cut by half to 3.35%, and if you miss the best 20 days, you are more likely not to make any returns at all.

On the other hand, if you stayed invested throughout all the rough times and good times, you would have made 7.47%.

It’s easy to think “oh no, I can’t miss those days”. Until you realize that you are more likely to only pull out for a market during a significant market downturn and most of the decade-defining returns tend to happen just immediately after those returns or even during the period. And these are times that you are more likely to be out of the market.

As JP Morgan noted in their study, “seven of the best 10 days occurred within two weeks of the 10 worst days, six of the seven best days occurred after the worst days and the second-worst day of 2020 – March 12 – was immediately followed by the second-best day of the year”.

Do you think that it’s easy to predict those days and execute your plan accordingly? That is selling your stake in the market because it’s red day and the following day catch the green cruise again? Hardly ever in reality. That is if you even think it at all. Much easy in retrospect.

Time in the market is more important than timing the market. The probability of reliably predicting market movement ranges from tough to impossible. The majority of investors would do well if they can just hold on to their investment and not panic sell.

There’s this principle popularized by Nassim Nicolas Taleb, it’s called the “uncle point”. It says the return you generate from the market is determined by when you started investing and when you reached your ‘uncle’ point.

Uncle point meaning the point when you panic-sell.

The very idea of selling in a bear market is anchored on the idea of cutting loss. So typically, you sell when your investment is in free fall (sometimes at the lowest point since you don’t know where that is). However, with a plan to get back in the market when it’s green again. Unfortunately, by the time it’s green again you might have missed the best days of return in the market. Again, you will benefit from staying invested than acting in panic.

Brian Feroldi said in a recent podcast that

“10% of your long-term return in the stock market will be determined by how you behave in the bull market and 90% of your long-term return in the stock market will be determined by how you behave in the bear market.”

I agree with him. I’ve gotten experience, I’ve gotten my hands burnt and I’ve taken time to analyze my past decisions enough to be able to relate with what he said.

Another way to deal with a bear market

A bear market is extremely tough to deal with. You will literally watch years (or months) of investment returns wiped out in your face within days. It’s tough, it’s emotional and our emotions will sell to us the logic of cutting our losses.

In 2020, I own UBER stock before the March event. At the peak of the fall, I couldn’t stand the rapid decline in UBER stock again so I sold it (panic sell). I was lucky not to have sold at the bottom of the fall. So when I saw that the price had fallen significantly again, I bought it back at a record low.

You notice a difference in my approach. I didn’t wait for a green cruise before buying it again. I bought it when it got to the low of lows. When everyone had forgotten about it as an investment option. It turned out to be the best-performing asset in my portfolio for the year returning about 90%.

That’s another way. But it’s even a tougher way than staying invested. You are buying it record low with no idea about what might happen, more fall, or no recovery at all. I was lucky with UBER I can say. The story could have been that when I sold it, I sold at the record low and then missed out on the eventual recovery and growth. But I just wanted to tell you that that is also an option.

The worst thing you can do is to sell in a bear market and wait for recovery or bull run before you start investing again. By then, you’ve missed out on the most important days of return, and you might just end up with a mediocre return relative to those who stayed invested.

You see, the best investment returns come from inactions and patience than from actions.

Also read this thread that I wrote: