Run! Naira Is Reducing You To Poverty

I’m tired.

I want to use my head to think of something else.

I’m tired of having to always think of a way to game the system I’m unavoidably part of.

I should be using my head and time to think about how to compound wealth. Unfortunately, most of my time is spent on thinking of a way to outsmart my country’s currency; Naira.

2020 has been a very rough year that we all can’t wait to get out off. For my home country Nigeria, it’s even more devastating. Amidst that, we woke this morning to the very bad news of entering another recession. If my counting is right, this is the 3rd or 4th of its kind during this administration that’s only just above 5 years into their government. Okay, it’s actually the second recession.

It got me worried. And while I could have used my time to think about the education of an Angel investor this day, I am here to sound an alarm about wealth erosion and write about how members of this community can protect themselves from an economy that’s bent on sapping every vitality from their hard work.

Naira punishes you for doing nothing

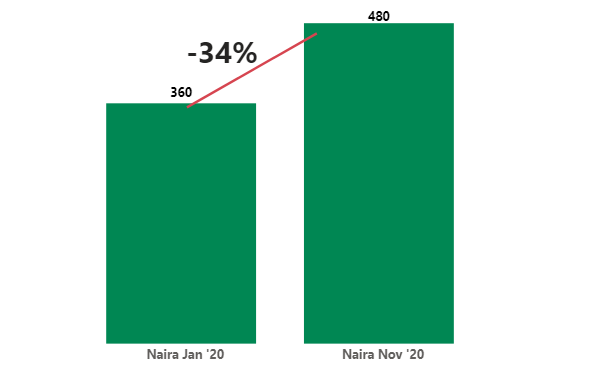

In just under 12 months, we have all gone poorer by an alarming percentage of 33.3%. We were told to save, and we saved. We were told to invest and we invested. We were told to be frugal and we have been. All these in an attempt to help us build wealth. However, it seems all that effort is worth nothing seeing Naira has decided to keep us in perpetual poverty.

It doesn’t matter how much you earn or save or invest nor does your frugality matter. Over the past few months, you have robbed of 1/3 of your wealth if that wealth is domiciled in Naira.

Inflation is the cruellest tax that there is. It saps the vitality of your wealth away subtly and slowly without your knowledge. You may be happy with the N10m in your bank account until you try to exchange that currency with value and you realize that the value of your N10m has been reduced to almost nothing in the market.

That’s why I said Naira doesn’t give room for doing nothing. You must act. Act always and act consistently.

Guide to escape the wealth erosion spree

You work every day and at the end of the month, you get paid some amount of money. Or it could be that you work and earn every day or infrequently. Whatever your case might be, I can bet that as you earn any income, you set apart a portion of it to save and another portion to invest. Something I’ve preached a countless number of times.

Naira is the problem. Not your work. So to escape wealth erosion, you’ve got to leave Naira alone as much as possible.

Here are things you can do with the money you are putting aside for savings and Investment:

Ordinarily, I believe you should have your money divided as follows:

- A portion that you spend will have to spend in a month

- A portion that is for emergency sake

- A portion that is invested for your long term wealth

That’s just to keep things simple.

There’s nothing you can do about the first portion, it must still be domiciled in Naira because you spend mostly in Naira. So leave that in Naira. Buy your foods and have your fun. Don’t let Naira give you a headache as it gives me sometimes.

The portion that you set for your emergency needs more attention.

An emergency fund is a bank account with money set aside to cover large, unexpected expenses, such as unforeseen medical expenses, home-appliance repair or replacement, major car fixes and, costliest of all, unemployment.

It all depends on how much this amount is in your bank account currently. However, if it’s already running in the mid 6 digits (> N400,000), I will generally advise that you save it this way:

50% should be kept with PiggyVest’s “Flex Naira”. For a simple reason, they offer easy access to your fund at the highest ROI (8%) in the market that I’m aware of.

50% should be saved in a dollar wallet. PiggyVest’s “Flex Dollar” is still an awesome choice for this. Especially because they still offer a 7% ROI on a flexible account. Otherwise, I will recommend you use an Eversend especially if you are the type that does a lot of crossborder payment or has some of your expenses domiciled in another currency other than naira, says dollars. Eversend also issues free virtual dollar card that is active on a lot of e-commerce sites. There other platforms that offer dollar wallets, if the two options above are not satisfactory.

Protecting your long term wealth

Alright, that’s about those. Let’s get into the real deal. The portion that was originally marked for longer-term investment; e.g. saving to build a house in some 5 years time, go to school in some 4 years time or funds for your children future education etc.

My answer for this is actually very straight forward. Avoid all naira denominated investment by all means. I seriously mean that. It’s that serious and crazy.

No matter the return that you might get on any naira investment this year, I bet that you do not have any real return. I will break it down a bit.

If you invested N100k in January 2020 and got 30% ROI (very rare) after 12 months ended December 2020, you would be happy that you made more money and indeed you made. However, Your new N130k can now only afford to buy $271 (@ N480/$). Whereas your 100k in January could have bought $278 (@ N360/$). That’s a negative return to start with.

You may puzzle and say but I don’t need dollars and I don’t have to buy dollars. Yes, that’s true. The reason I am fond of converting your income to dollars is basically to serve as a proxy for a store of value. It is not to say you have to convert your money to dollar. Another example would have been me using the price of a bag of Rice, the food we all eat.

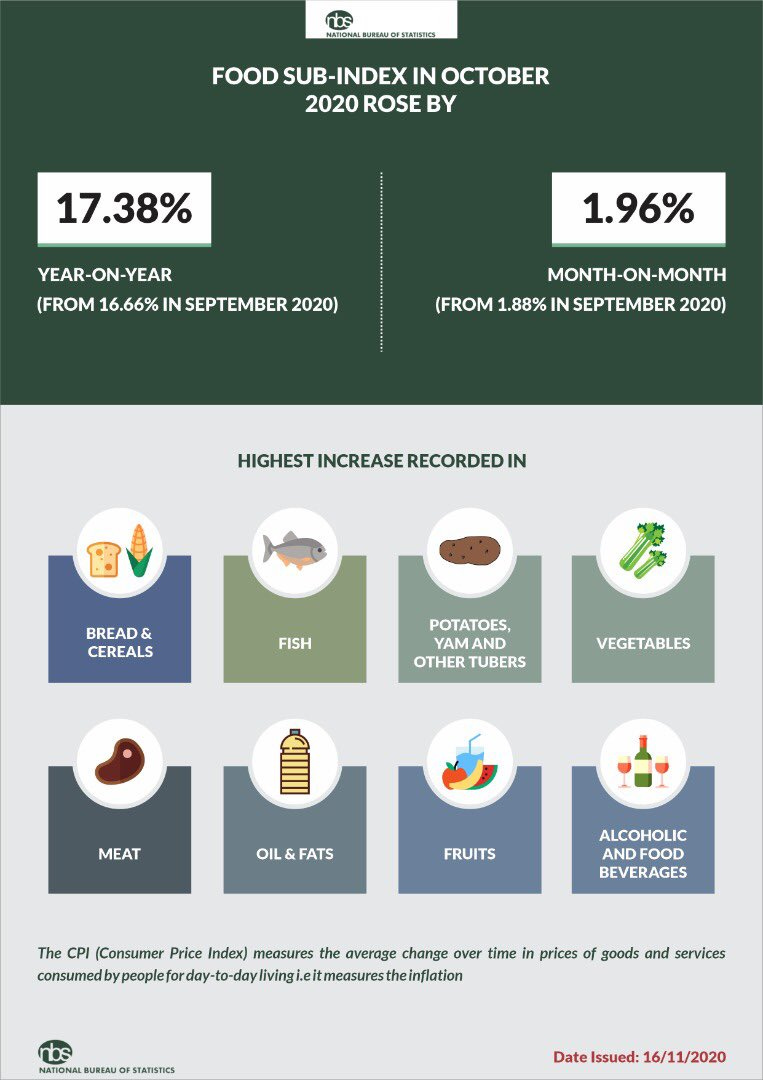

Here’s NBS data on food inflation. An alarming 17% increase year-on-year. Which invariably reduced your real return by that percentage and you are left with a little percentage above 10%. However, note that that’s just food inflation. You don’t spend on food alone. To avoid the complication of having to talk about different inflation rate is one of the reasons why I normally resort to using dollar as a proxy.

I hope that scares you a bit? Please let it scare you.

I am not an alarmist and my message has not changed. Flee any investment in Naira. Here are places you can flee to:

RiseVest – All assets offered by this startup is denominated in dollars. I believe that any asset class that you go with will definitely outperform any type of Naira investment in the short and long term. RiseVest gives you exposure to Real Estate assets, Fixed Income and US Stock. You can’t have it any better.

Buy US Stocks or ETF yourself – if you know how this works, do it. Trove Finance and Invest Bamboo are equally great to check them out. By stocks that are of good quality and buy ETFs like QQQ, VTI, VTG ARKK, ARKW. Any of those ETFs are good and I recommend them (at your risk of course, lol).

Buy Cryptoasset – this is riskier but having 10% of your investable amount in it is a good start. Ok, I mean Bitcoin now when I say Cryptoasset. This is not an article to tell you the economics of that and the potentiality. I just have to mention it in term of alternatives that’s all. As a community, I know we’ve had a conversation about this before and if you have more question about it, you may chat me up.

All that I’ve said so far is just an opinion piece and advice. What you do with your money is still largely dependent on you. But I urge you that you should not do nothing. It’s a sin the book Naira Chapter 1:1 to do nothing.