The Most Important Thing To Consider While Investing In ETF

I am a huge advocate of ETF investing vs stock picking. In how to start investing, I explained the reason for my preference. However, there are more than 1,000 ETFs listed in the US stock exchange and that may bring one back to the same dilemma they are trying to avoid, the choice paradox.

That should not happen and I will give you the criteria to narrow down on which one you should even consider at all.

The most important variable for passive ETFs

The underlying index or companies is the most important factor here. What are they tracking?

Passive ETFs are not managed, i.e. stocks are not being added or sold from them daily but on a given interval or when there is a trigger. Which means the most important factor in this type of ETF is the underlying companies. This is important because this group of companies could be part of the holdings for many years. And if they are not companies that will help you achieve your investment objectives, then you shouldn’t invest in the ETF.

SPY is an example of an ETF that has the top 500 companies listed in the US in its portfolio. By implication, buying it would mean you are buying the top 500 companies in the US notwithstanding their sector or growth stage.

VGT is another that has only the top 100 technology companies listed in the US in its portfolio.

The list goes on. Once you check the underlying stocks are in the ETF and you are comfortable with it to hold for over a long term, your work is largely done. Just use cost averaging to invest until forever.

I would like to repeat that investment should be as simple as possible. Don’t make things complicated for yourself.

The most important variable for active ETFs

The most important variable here is management. It’s not the companies they are invested in but the management, those managing the fund.

This is because you may wake tomorrow and realize that a company is no longer part of the holdings. But you want to be sure the people deciding what should be included or not are of great competence to make such decisions.

ARKK is a favourite of mine, and I will be using it as an example again. The fund manager is Cathie Wood, and she has pulled together a team of experts in different areas to be the manager of each destructive company that they have under management. They know something more than what I know about 3D printing or Genomics for instance. Some of them were former PhD researchers in the competence where they now happen to be investing. Some have done investing for long enough to notice patterns. Looking at management composition as this gives you the confidence to determine if it is right to jump the ship with the ETF.

Beyond that, ARKK also boasts of an investment strategy called thematic investment. Thematic investing is a strategy that seeks to align asset selection with certain social, economic or corporate themes prevalent in society. All these are things that you observe and use to access the capability of the managers.

As you can see, though, it’s more “complex” than the passive in terms the most important variable to know. That’s because now more risk is involved and as such more homework is required from you to access your readiness to invest long term with the funds. I said long term because you only have to do this research once, after that, you are good to go.

Well, it’s also the case that one of the reasons why you are going for the active ETFs is because of the promise to outperform the passive alternatives. So it’s not just about taking on more risks alone, you may also get rewarded for the risk.

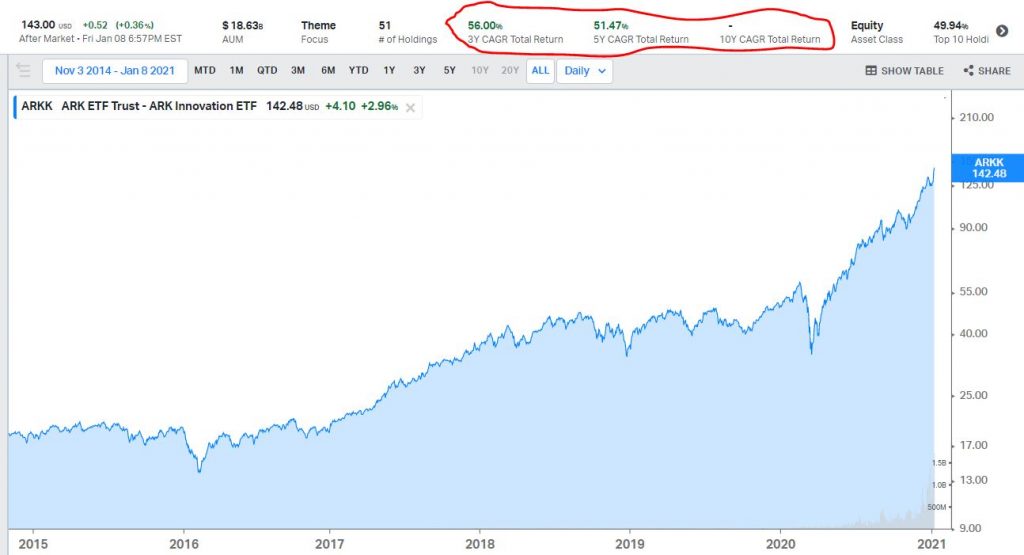

The result that follows such a manager is usually a testament to their expertise as well. ARKK in this scenario has done a cumulative average return of 50% per year in the past 5 years.

Hello, I need to inform you that management assessment is not enough for determining which active ETF to invest in. Sorry, it’s just important that I tell you everything.

The second important factor is the theme of the ETF. Each ETF has a theme of focus, ARKK in our example invests in disruptive innovation companies, ARKW invests in what it calls “next-generation internet” companies. These themes are important to understand what kind of companies you can expect them to invest in later in the future and what you can’t expect.

Talking about what you can’t expect, you won’t find Coca-Cola company in the holdings of ARKK no matter how good the company may be performing. And it’s fine to have all expectations aligned.

With all these in perspective, we have narrowed down on how you can easily access the ETFs and determine what to invest in. The twist is that you cannot narrow down for a single company like this at all, the way it works for individual companies is that you address them singularly on their kind of metrics. That can be a lot of work sometimes and except you enjoy it, it’s needless.

Well, with this new understanding, please go on and make your investment of the decade and build wealth with time.