Why You Will Never Buy The Dip

Did you buy the dip? he asked. After waiting for 24 hours and an eventual rally, not a single soul came out to say they bought the dip (price drop). That is how the story always starts and ends.

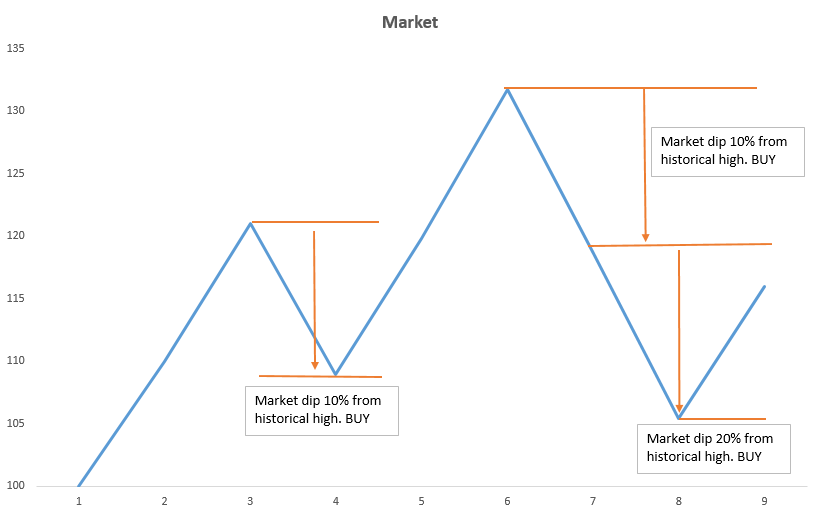

Whenever an asset price rises, the quest to benefit from such a rally forces everyone to want to get on the train. Unfortunately, the rally gets so high that everyone is now waiting for a drop in price before they buy the asset to benefit from its rally back to the top again.

The fortunate thing is that every asset almost always has this dip that everyone is waiting for. Unfortunately, almost no one would have the mental fortitude at that time to buy what they’ve been waiting for. This phenomenon surprises me. So I pondered on it to come up with an explanation of why that is and a possible solution or way forward.

This is why no one ever buys the dip

- Psychology – we are not wired to process such a scenario properly as humans. We like our money and accepting loss is not our forte. Buying a dip means the value of your asset may start declining immediately after your purchase. What we are psychologically wired for is to assume the dip is not dipped enough yet, hence we should wait till it’s deep enough before we buy. Unfortunately, knowing when we have reached the bottom of the dip is close to impossible and so we all miss buying the dip. Ordinarily, an asset price would then stabilize at the dip or start to rise again. The problem is we can’t time any of these events. And our inability to time it is the primary reason why we don’t usually buy the dip.

- Volatility – we don’t know if it will rally again or not and if it does, we don’t know when. When a dip starts whether you buy the dip or not depends on your estimation of how deep the dip can go and how soon it will recover. For a very volatile asset like Bitcoin, it’s almost impossible to tell all those variables and that makes it even harder to buy the dip. The more volatile an asset is, the harder it is to buy the asset’s dip. For context, there’s nothing and I mean nothing stopping Bitcoin from losing 50% of its value in a very short time and there’s no promise as to when it will recover that back. This makes it difficult to buy any dip. How deep a dip can go relative to the time it would take for the dip to recover is a metric that would determine how easy it is to buy a dip.

It is possible to buy the dip

Buying the dip is easier and often possible if you have a long term investment horizon and you are investing an amount of money that would not materially affect your lifestyle if you do not have access to the money for a very long time.

I bought (all) the Bitcoin dips for example. Yes, I meant that. I bought all the dips but I also bought all the highs.

“Time in the market is more important than timing the market”

Every now and then, I transfer a given amount to my Luno wallet and automate a daily purchase of some Bitcoin. By implication, whether Bitcoin is high or down, dip or all-time high, my order will be executed. However, since I am not making a one-off purchase, the impact of any one purchase on any given day will not materially affect my returns.

If I bought at an all-time high, it would just be a one day purchase out of many other days that I’ve been buying and that won’t have any significant impact on my overall returns. The same goes for buying when there’s a dip. As long as my standing order is there, it doesn’t matter if it’s a dip or all-time high, the order gets executed.

Buying the dip has only been made possible for me because of that practice. If I’d had to buy it myself, I can assure you just as you couldn’t, I wouldn’t have bought it as well. I am no special human and I have the same genetics of fear and greed as anyone else. It is how we manage it that differentiates us.

Also, I could successfully do that because I am holding a long term horizon for Bitcoin. The last I checked my account, for instance, I’ve made >130% from my boring daily standing order. But I had no urge to sell and I don’t mind if I lose all that huge percentage returns. I will only have more opportunity to buy the dip.

If you think you can do otherwise, i.e. buy the dip yourself, you overestimate yourself and know little about yourself. You can’t buy the dip except you have those two things well thought; your time in the market (how long you want to be invested) and the kind of money that you have in the market (if it won’t affect their livelihood).

But seriously, did you buy the dip? I’m curious.